Start your ownership journey with a proven model, transparent investment, and financing options that help you launch with confidence.

Owning a business shouldn’t mean taking on unnecessary risk. Shine makes franchise ownership accessible, affordable, and rewarding — helping first-time and experienced entrepreneurs pursue low-cost cleaning franchise opportunities with strong long-term potential.

With a straightforward investment range and flexible financing options, you can take the leap into ownership backed by proven systems, national brand support, and a clear path forward.

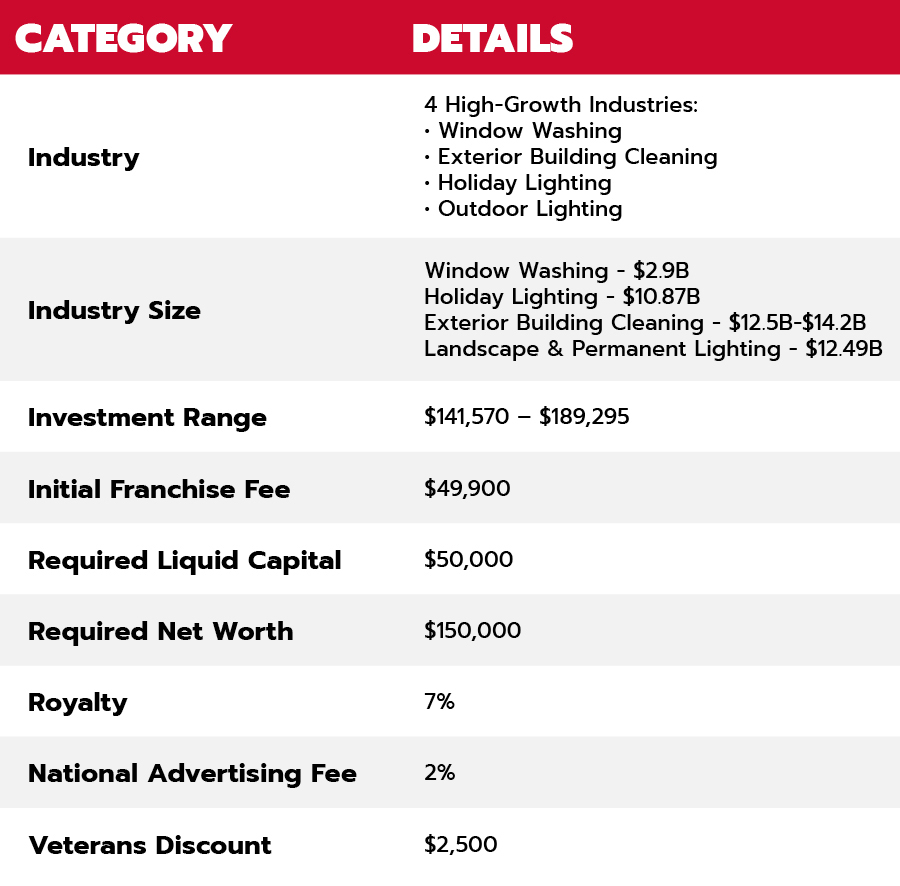

Our scalable, service-based franchise model offers a low-cost entry point backed by over two decades of operational excellence. Every figure below is detailed in our Franchise Disclosure Document (FDD) to ensure transparency and accuracy.

Whether you’re a retired corporate professional, transitioning entrepreneur, or growing your business portfolio, Shine provides a clear, structured path to sustainable growth.

Your investment includes everything needed to launch with confidence — professional-grade equipment, training, marketing support, operational systems, and a dedicated team guiding you every step of the way.

*Financial performance information is available upon request.

To review average franchise revenue and profit margins, request access to our Franchise Disclosure Document (FDD, Item 19) and learn what real Shine Franchise Owners are achieving today.

We understand that starting a new business is a big decision, and financing shouldn’t stand in your way. That’s why Shine partners with trusted lenders who specialize in franchise funding, offering multiple pathways to help qualified candidates get started.

Loans serve as a versatile financing option, providing the capital needed for various business purposes. Whether you’re looking to cover working capital, invest in a franchise or grow your business, loan options are designed to meet your unique requirements.

Benefits:

Specifically crafted for start-ups and existing businesses, the Small Business Administration’s (SBA) 7(a) Loan Program is a robust financing solution. The application process is streamlined, ensuring efficient access to funding.

Benefits:

This program targets smaller loan amounts, catering to the unique financial needs of startups and existing businesses. It enables you to meet cash requirements without the need to sell assets.

Benefits:

Securities-Backed Line of Credit offers a quick and straightforward solution for accessing funds. Backed by your securities, this line of credit provides the liquidity you need with added benefits.

Benefits:

The Rainmaker Plan offers a unique opportunity to access existing retirement funds tax-deferred and penalty-free, providing a robust source of financing for your Shine franchise.

Benefits:

Shine’s model was designed to give first-time owners an attainable way to achieve business ownership. With six complementary revenue streams, low overhead, and year-round demand, Shine offers an exceptional return on investment compared to other service-based franchises.

It’s more than an investment, it’s a purpose-driven opportunity to own a business that makes a difference in your community.

Revenue Streams

Franchise Fee

Average Startup Costs

Average Gross Revenue For 3-5 Year Owners*

(See 2025 FDD – Item 19)

Highest Gross Revenue*

*As stated in our 2025 Franchise Disclosure Document. Owners open between 3-5 years.

Owning a Shine Franchise is more achievable — and more rewarding — than most people realize. With full support from financing to training to your grand opening, our team helps evaluate a low-cost franchise opportunity with clarity and confidence.

If you’re ready to explore a franchise investment built for long-term value, this is your next step.

The total investment to open a Shine franchise varies based on factors such as market, business plan, and local setup. The total initial single-territory investment ranges between $141,570 and $189,295.* Detailed investment ranges are outlined in Shine’s Franchise Disclosure Document (FDD).

The initial investment includes franchise fees, initial training, service & sales vehicles, equipment, grand opening marketing t, and operational systems needed to launch. A full breakdown is available in the FDD to ensure transparency.

Shine works with franchise-experienced lenders who offer multiple financing solutions, including SBA-backed loan programs and alternative funding options. These partners understand Shine’s business model and help qualified candidates explore financing paths aligned with their goals and financial profile.

Yes. Shine partners with lenders familiar with franchise funding, including SBA-backed loan programs, to help streamline the financing process for approved candidates.

The liquid capital requirement is $50,000 and the net worth requirement is $150,000.These requirements help ensure Franchise Owners are positioned for a successful launch and sustainable growth.

Shine’s financial performance representations are outlined in Item 19 of the Franchise Disclosure Document (FDD). This information is shared during the franchise discovery process and provides insight into historical performance for qualifying Franchise Owners.